Failup Ventures, a venture capital firm based in Finland, has successfully secured €30 million in the initial closing of its new early-stage fund.

co-founder and General Partner at Failup Ventures, expresses excitement about the launch of Failup Ventures as the first Finnish VC fund with a significant presence in the US. Soininen emphasizes the global approach and grassroots networks that enable the identification and support of promising early-stage teams.

Soininen goes on to highlight the success of previous investments, noting that many have attracted follow-on investments from well-known firms such as A16Z, NFX, General Catalyst, and Tiger Global. This success, according to Soininen, serves as a testament to Failup Ventures’ ability to recognize outstanding teams and contribute to grassroots efforts.

A Finnish-American venture capital fund

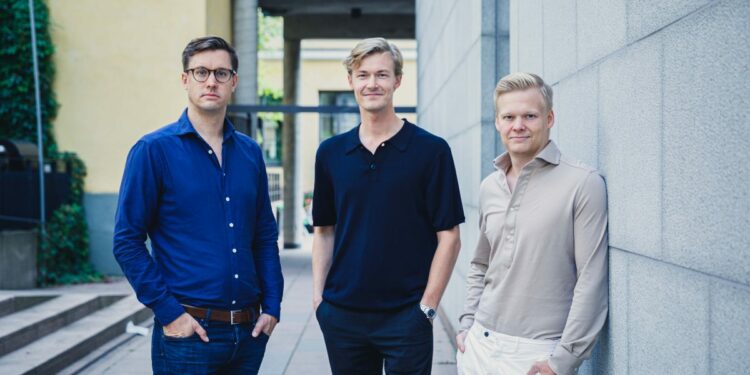

Founded by Jesse Heikkilä, Topias Soininen, and Oscar Andersin, Failup Ventures is a Finnish venture capital firm dedicated to backing early-stage startups. The firm’s initial investment commitment spans from €200K to €1M, and it possesses the capability for more substantial follow-up investments.

Failup Ventures distinguishes itself by its notable presence in the United States, offering extensive networks and access to international deal flow, setting it apart in the competitive venture capital landscape.

The firm’s global outlook enables it to discover and assist startups in both the Nordic region and the United States, drawing attention from a diverse array of fund investors, including entrepreneurs.

The founders of Failup, Heikkilä and Soininen, acquired expertise in high-growth startups and achieving product-market fit through their venture, Playven. Playven was a SaaS sports facility management and marketplace company that they later successfully sold to Playtomic.

On the other hand, Andersin, having served as an Investment Manager at Vencubator, a startup incubator in Helsinki, contributes his valuable insights to the team. Together, the trio boasts a collective involvement in building and investing in nearly 40 startups through their prior angel investments.

Co-founder Heikkilä states, “We’ve observed that founders lean towards collaborating with individuals who possess firsthand experience in building a company and have encountered similar challenges. This aligns with our own journey before establishing Failup.”

Heikkilä expresses excitement about charting the path for the next generation of founders through their fund, supported by next-generation investors. He adds, “We are thrilled to have some of the brightest entrepreneurs backing us as Limited Partners.”

Failup’s investment themes

The fund, taking a sector-agnostic approach, focuses on mission-driven founders aiming to create a positive impact on society, work, health, or the environment.

Co-founder Andersin emphasizes, “Our dedication is to support founding teams developing solutions with the potential for genuine improvement. We are specifically interested in investing in teams that align with our values.”

“The initial meeting with the Failup team centered on our values—what we stand for and the kind of world we aspire to contribute to building.”

Failup has already funded three early-stage teams as part of its portfolio. These startups include Foundernest, a Generative AI aiding corporations in enhancing market landscaping, exploration, and insights; Ever, a marketplace focused on electric vehicles; and Vested Health, a company with a vision to revolutionize healthcare.

Failup Ventures directs its investments towards key themes like the Future of Work, Future of Consumption, Dynamic Marketplaces, Digital Infrastructure, and Commercial Climate Tech. These thematic areas serve as a compass for the fund, guiding its support for startups that play a pivotal role in shaping the evolving landscape within these sectors.

“The initial meeting with the Failup team centered on our values—what we believe in and the type of world we aim to contribute to constructing.”

Failup has already invested in three early-stage teams through its fund. These startups include Foundernest, a Generative AI assisting corporations in enhancing market landscaping, exploration, and insights; Ever, a marketplace focusing on electric vehicles; and Vested Health, a company with a vision to revolutionize healthcare.

Source:siliconcanals