Breaking Down Barriers: Cleva’s Mission to Streamline Global Finance for African Individuals and Businesses

Cleva, a Nigerian fintech founded by seasoned tech veterans, has secured $1.5 million in pre-seed funding to tackle the persistent challenge of receiving international payments across Africa. The platform empowers individuals and businesses with USD accounts, paving the way for smoother financial transactions in an increasingly globalized world.

Backed by Silicon Valley Powerhouses:

The pre-seed round witnessed support from renowned investors like 1984 Ventures, The Raba Partnership, Byld Ventures, FirstCheck Africa, and a network of angel investors. Aaron Michael, a partner at 1984 Ventures, lauded Cleva’s founders, Tolu Alabi and Philip Abel, highlighting their exceptional technical prowess and deep understanding of the African market’s needs. “The team’s unique experience from Stripe and AWS, coupled with Cleva’s impressive early growth, makes them well-positioned to revolutionize this space,” he remarked.

Joining the Y Combinator Family:

Further adding to its momentum, Cleva has also joined Y Combinator’s winter 2024 batch, joining the ranks of other African startups like Grey Finance and Elevate that empower freelancers and remote workers on the continent. This prestigious association underscores Cleva’s potential and ability to disrupt the African fintech landscape.

Solving a Persistent Pain Point:

With a market estimated at $18 billion, facilitating payments for remote workers and freelancers in Africa remains a significant challenge. Alabi and Abel, both Africans who navigated these hurdles firsthand, founded Cleva to eliminate the friction associated with receiving international payments for skills and products. They emphasize that the problem extends beyond Africa, impacting individuals across Latin America, Asia, and beyond.

Building a Compelling Solution:

Cleva differentiates itself from competitors through two key aspects:

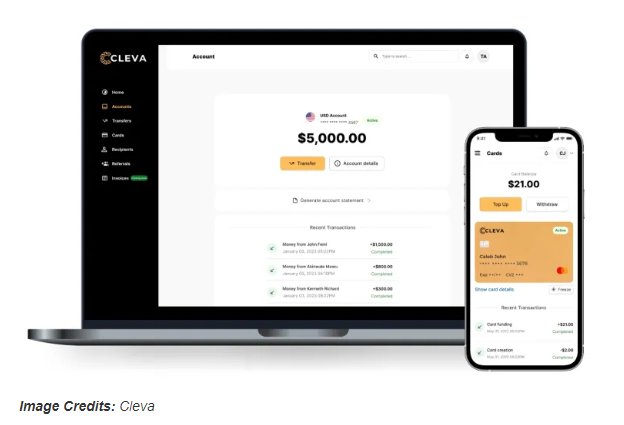

- Exceptional Customer Experience: Prioritizing user satisfaction, Cleva boasts responsive customer support and a seamless user interface, addressing a common pain point in the fintech space.

- Transparent and Competitive Fee Structure: Whereas many competitors charge uncapped fees, Cleva offers a transparent cost structure with a 0.9% deposit fee and a $20 cap, making it more accessible for users.

Future Plans and Expansion:

Cleva’s roadmap is packed with exciting developments. Upcoming features include:

- USD Cards: Providing users with convenient access to their funds.

- Savings in U.S. Assets: Offering secure and flexible investment opportunities.

- Diaspora Expansion: Reaching out to Africans residing abroad.

- API Development: Building a platform to integrate with other services and expand reach.

A Catalyst for Growth:

With a booming population of skilled individuals and a rapidly growing digital economy, Africa presents a fertile ground for fintech solutions like Cleva. By simplifying international payments and fostering financial inclusion, Cleva is poised to empower Africans and bridge the gap between the continent and the rest of the world.

Source: TechCruch

Leave a Reply