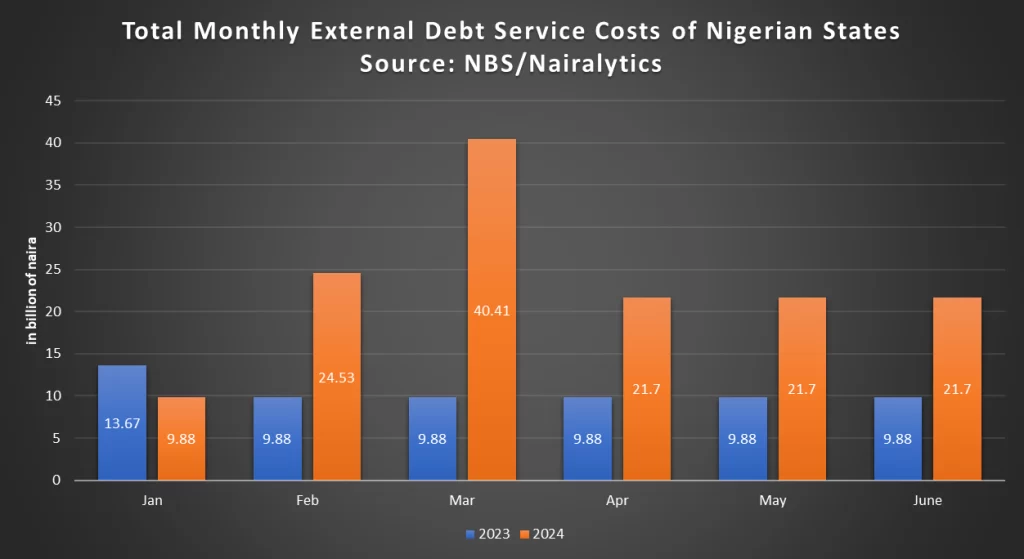

According to study findings based on Federal Account Allocation Committee (FAAC) records by the National Bureau of Statistics (NBS), Nigerian states have collectively utilized approximately N139.92 billion for servicing external debt during the initial six months of 2024. This expenditure represents a notable 122% surge from the N63.06 billion spent during the same period in 2023.

Escalating Debt Service Costs

The data demonstrates a substantial increase in monthly debt servicing expenses for the states—from roughly N9 billion to over N20 billion—a shift likely influenced by the devaluation of the naira.

Variations in Monthly Expenditures

- January Comparison: In January 2024, states disbursed N9.88 billion for external debt servicing, showing a decline from the N13.67 billion spent in January 2023. This 27.7% reduction could suggest fewer debt obligations for certain states during that month, coinciding with an exchange rate ranging from N830/$1 to N1,000/$1.

- February Surge: By February 2024, debt servicing payments markedly increased to N24.53 billion, signifying a steep 148.2% rise from the previous year. This surge possibly reflects the impact of currency depreciation on repayment costs.

- March Peak: March 2024 witnessed the highest expenditure on debt servicing at N40.41 billion, a remarkable 309.1% upsurge from the prior year’s N9.88 billion. The spike in March may be tied to increased debt obligations maturing towards the end of the quarter.

- Stabilized Costs April-June: External debt servicing expenses remained stable at N21.70 billion monthly from April to June 2024, marking a consistent 119.70% increase from the same months in 2023. The reduction in April from the peak in March could indicate completed debt cycles, although the sustained high levels underscore enduring financial strains.

Growing Fiscal Strain

This substantial outlay underscores the mounting fiscal burdens on state governments as they grapple with escalating debt obligations, emphasizing the financial challenges they face in managing their respective budgets.

Kaduna and Lagos states emerged as significant spenders, with Kaduna allocating N23.08 billion and Lagos committing N32.44 billion towards external debt servicing over the first six months of 2024. Kaduna witnessed a substantial threefold increase, rising from N9.89 billion, marking a remarkable 133% surge. Similarly, Lagos State, a key economic hub, experienced a notable escalation in debt servicing costs, from N16.88 billion in H1 2023 to N32.44 billion in H1 2024, marking a significant 92% increase. These two states collectively covered 40% of the total external debt servicing expenses during the review period.

Steep Increases Across States

Cross River and Bauchi states witnessed considerable rises in their debt servicing obligations, with Cross River’s costs escalating dramatically from N2.21 billion in 2023 to N7.87 billion in 2024, marking a 256% increase. Bauchi State’s debt servicing expenses surged from N3.28 billion to N6.33 billion during the same period, reflecting a substantial 93% rise. Ogun State recorded a marked increase from N1.57 billion to N4.29 billion, reflecting a 173% increase, while Oyo State’s debt servicing costs rose significantly, from N2.61 billion in 2023 to N6.36 billion in 2024, marking a 144% increase. Rivers State also witnessed a significant increase, rising from N1.76 billion to N4.62 billion in the same period, reflecting a 162% increase.

Concerns Amid Rising Costs

Nigerian states grapple with growing fiscal pressure due to escalating external debt servicing costs and a volatile foreign exchange environment. States, including Ekiti, Cross River, and Ogun, have expressed concerns regarding the rising costs of foreign debt service, attributing this to severe foreign exchange volatility. There have been calls for a possible suspension of debt repayment for multilateral loans to alleviate cash flow strain, as the financial burden caused by rising exchange rates has escalated the costs of foreign debt repayments.

Fiscal Challenges and Debt Management

While states have actively worked to reduce their domestic debt stock, the marked increase in external debt servicing poses concerns about the fiscal health of Nigerian states. Rising debt costs could potentially divert funds from critical sectors such as health and education, highlighting the importance of effective debt management and the fiscal challenges faced by the states.