The World Bank’s latest revelation underscores a dire situation for 24 of the world’s lowest-income economies, which are projected to expend a staggering $21.5 billion in 2024 to service their external public debt. The International Debt Report 2023, released by the Bank, unveils a startling reality – in 2022 alone, low- and middle-income countries grappled with an unprecedented $443.5 billion in payments to meet their external public and publicly guaranteed debt obligations.

The gravity of this financial predicament is further accentuated by recent events, as Ethiopia becomes the third African nation, following Ghana and Zambia, to default on sovereign bonds within a three-year span. Ethiopia’s default involves a substantial $33 million interest payment, signaling a growing trend of financial instability in the region.

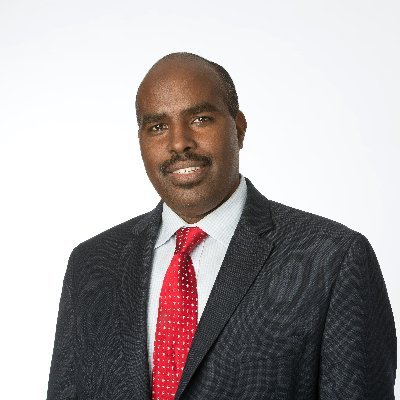

The World Bank’s report serves as a resounding alarm, highlighting the imminent risks confronting low- and middle-income economies. Professor James Gathii, a founding editor of Afronomicslaw, a network advocating for African sovereign debt justice, remarks on the severity of the situation. “As Ethiopia’s default this month indicates, African countries will continue to face severe financial pressures in debt repayments,” he warns.

@Loyolalaw

| Founding Editor

@Afronomicslaw

| Co-Editor-in-Chief African Journal of International Economic Law.|

emphasizes that it’s not merely a matter of African countries borrowing excessively; the crux of the issue lies in the inherent unfairness of the global financial system and debt architecture. This sentiment echoes a growing chorus calling for a more equitable approach to addressing the mounting debt crisis in the developing world.

The International Debt Report 2023 sounds an additional warning, revealing that one in four developing countries is effectively excluded from international capital markets. The report sheds light on the paralyzing burden of debt faced by the poorest nations, with 28 countries eligible to borrow from the World Bank’s International Development Association (IDA) now at high risk of debt distress, and 11 already in distress.

In the past three years alone, 18 sovereign defaults have occurred in 10 developing countries, surpassing the total recorded in the previous two decades. This trend underscores the urgency of addressing the global financial dynamics that perpetuate debt challenges in the developing world.

Private creditors withdrawing from developing countries further compounds the issue, limiting available financing options. Gathii notes the prioritization of private creditors in revenue collections over crucial public expenditures like health, education, and housing, exacerbating the impact of the debt crisis.

Looking ahead, Gathii predicts continued challenges for African countries, including Kenya, Zambia, Ghana, Ethiopia, Zimbabwe, Mozambique, Nigeria, and Senegal. The global economic outlook for 2024 appears unpromising, indicating that these nations will likely grapple with sustained debt distress.

A significant contributor to Africa’s debt woes is the continent’s struggle to generate domestic resources for development. With African countries maintaining a tax-to-GDP ratio of approximately 15 percent, the lowest globally and half that of OECD countries, there is a glaring gap in funding crucial public services. Chenai Mukumba, executive director of Tax Justice Network Africa, emphasizes the impact on low-income households and marginalized individuals, as limited tax revenue is diverted toward servicing debts rather than vital public services.

The debt-to-GDP (gross Domestic product) ratio serves as a key indicator of a country’s indebtedness, with Ethiopia’s ratio at 46.37 percent, lower than that of many advanced countries. However, the external component of Addis Ababa’s debt remains substantial, accentuating the need for comprehensive debt management strategies.

In Kenya, a looming fiscal challenge is evident in the draft supplementary budget estimates, highlighting the risk of fiscal slippage. The Kenya shilling’s significant depreciation against the dollar, approximately 31 percent since the beginning of 2023, adds to inflationary pressures and increases the country’s debt-servicing costs. The growing mismatch between the demand and supply of dollars poses a challenge for managing debt in 2024.

Mukumba advocates for debt cancellation as part of a broader strategy to address the debt crisis, recognizing the historical unfairness within the global economic system. Emphasizing the need for increased domestic resource mobilization, Mukumba highlights combating tax avoidance and evasion practices perpetrated by multinational corporations as a crucial step toward sustainable development.

As the specter of debt looms large over African nations and other developing economies, urgent and coordinated efforts are essential to foster a fairer global financial system that enables sustainable development and equitable economic growth.

Source: The Eastern African

Leave a Reply