The Economic Opportunity Coalition (EOC), which consists of nearly 30 private sector companies and foundations, is taking significant steps to support small Black businesses. In anticipation of the U.S. Department of the Treasury’s annual Freedman’s Bank Forum, they have announced their intention to secure $3 billion in deposits forMDIs (CDFIs) and minority depository institutions (MDIs). These institutions have historically played a crucial role in serving marginalized communities, particularly in rural and low-income areas.

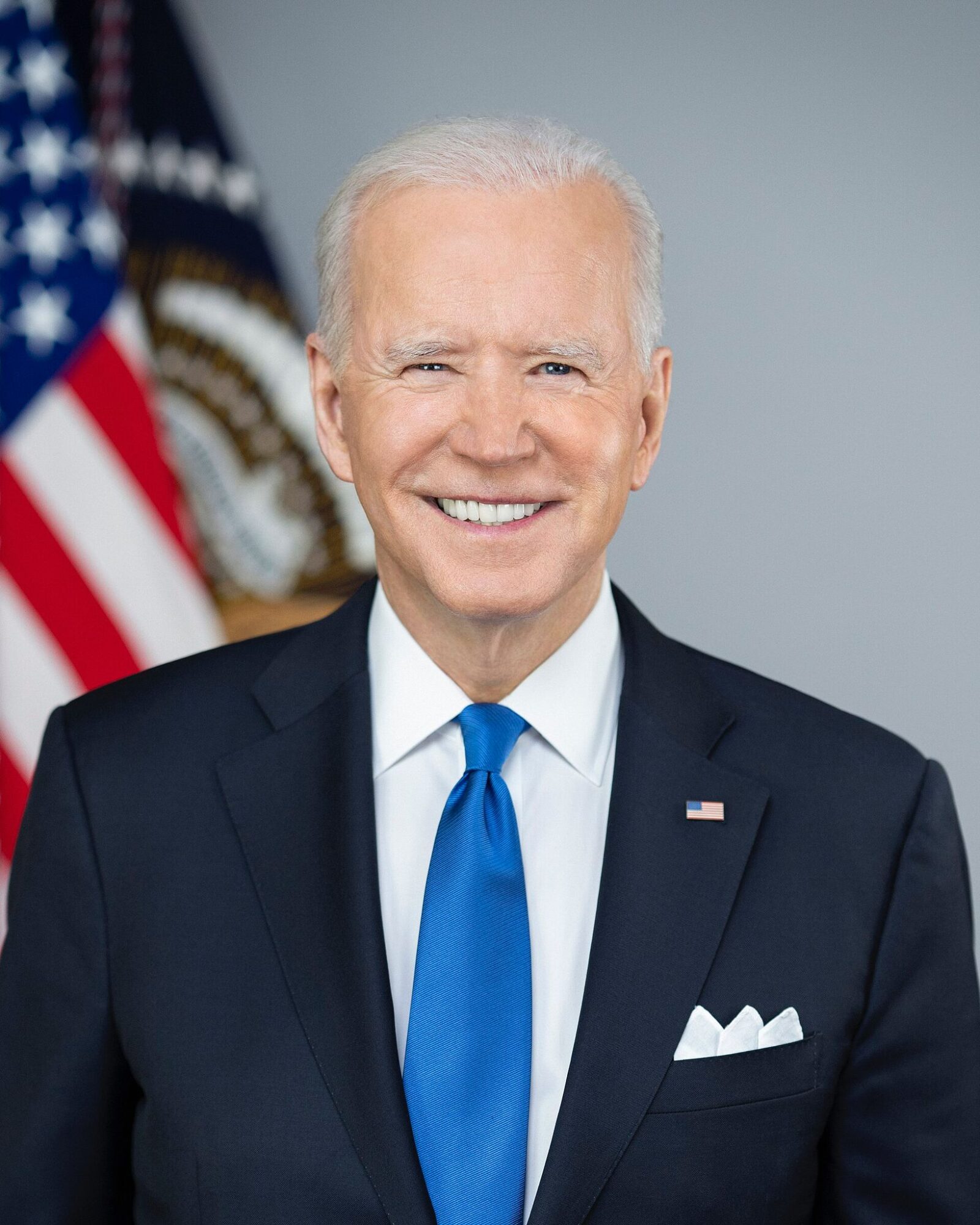

Vice President Kamala Harris

has emphasized the need for companies in sectors such as semiconductor manufacturing, clean energy, and biomanufacturing to diversify their supply chains. By 2025, she suggests that these industries should allocate at least 15% of their contract spending to small and underserved businesses.

In line with this vision, companies like Micron, Air Products, and Xcel Energy have committed to this approach. Their involvement goes beyond financial support; they are also providing technical assistance to help potential suppliers from underserved communities navigate the complexities of the business world.

Additionally, Google has announced plans to dedicate at least $1 billion annually to diverse-owned suppliers in the United States. Such investments have the potential to expand the pool of suppliers, bringing new perspectives and innovative solutions to the market.

Supporting and financing Black-owned businesses is crucial for several reasons. It helps address historical economic injustices and systemic disparities that have disproportionately affected Black entrepreneurs and communities. These businesses often serve as vital anchors in their communities, offering goods, services, and job opportunities that might not otherwise be available. Furthermore, promoting diversity in the business landscape fosters innovation by introducing diverse perspectives and experiences, enriching the marketplace with a wider range of products and services. Investing in Black-owned enterprises not only promotes economic equity and social justice but also stimulates regional economic growth, creating a more inclusive and resilient economy for all.

Earlier this year, the EOC achieved its goal from the previous Freedman’s Bank Forum by securing $1 billion in deposits for CDFIs and MDIs. Their recent announcement represents a significant increase from their previous commitment, indicating that more resources may become available to underserved communities.

In collaboration with the EOC, the Treasury Department aims to maximize the impact of their investments, particularly in communities seeking to establish a foundation for sustainable economic growth. The Department’s substantial investment in CDFIs and MDIs through programs like the Emergency Capital Investment Program aligns with the efforts of the EOC. These initiatives enhance the ability of CDFIs and MDIs to provide loans, grants, and other financial services, benefiting minority-owned businesses and individuals in underserved communities.

Leave a Reply