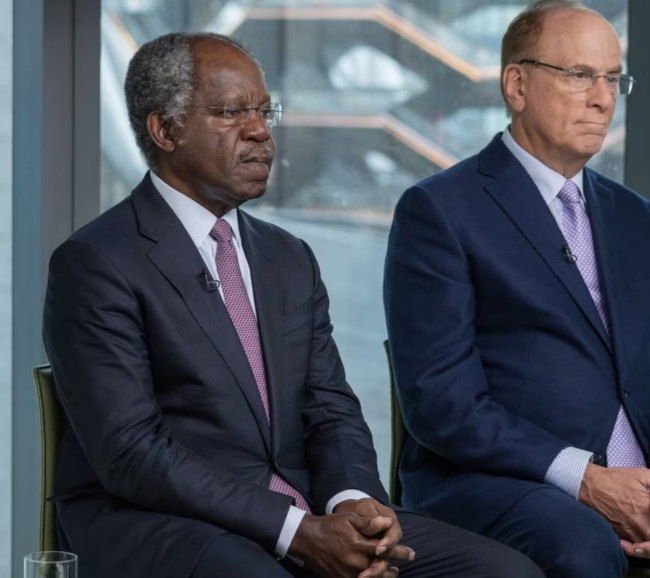

In a significant development within the financial sector, BlackRock, a global investment management firm, has initiated the acquisition of Global Infrastructure Partners (GIP), founded by Adebayo Ogunlensi, for a staggering $12.5 billion. This move has prompted David Solomon, CEO of Goldman Sachs, to announce that Ogunlesi, who currently serves on the board of Goldman Sachs, will be required to step down due to his association with BlackRock.

Understanding Global Infrastructure Partners (GIP)

Global Infrastructure Partners (GIP) stands out as an independent infrastructure fund manager, overseeing businesses and assets across various sectors, including energy, transportation, digital, water, and waste. Noteworthy elements in its diverse portfolio include Edinburgh Airport, Gatwick Airport in Britain, Ports of Brisbane and Melbourne, East India Petroleum, Sydney Airport, and the Ruby Pipeline. Managing a substantial $100 billion in assets, GIP’s equity portfolio generates an impressive $80 billion in combined annual revenues.

BlackRock’s Financial Landscape and Strategic Shift

During the last quarter of 2023, BlackRock experienced revenue stagnation, coupled with scrutiny over its environmental, social, and corporate governance initiatives in the United States. In response, the firm, currently managing assets totaling $10 trillion, has redirected its focus towards infrastructure investments. Larry Finks, BlackRock’s Chairman and CEO, emphasizes the potential of infrastructure as a long-term investment opportunity, given its capacity to influence the global economy. The acquisition of GIP aligns with BlackRock’s strategy to expand its alternative investments.

Rationale Behind the Acquisition

The collaboration between BlackRock and GIP is anticipated to create a synergy that leverages BlackRock’s extensive global connections with corporations and sovereigns alongside GIP’s distinctive origination and business enhancement capabilities. This combination is expected to establish a diversified and extensive sourcing platform, facilitating deal flow and co-investment opportunities for clients. Larry Finks notes, “We believe bringing GIP and BlackRock together will deliver to clients the benefits of broader origination and business improvement capabilities.”

BlackRock’s Vision: Infrastructure as a Key Investment Opportunity

Larry Finks underscores the transformative potential of infrastructure, emphasizing its pivotal role in the global economy. Infrastructure, which forms the core of GIP’s expertise, is perceived by BlackRock as a promising avenue for long-term investments. This strategic move positions BlackRock to capitalize on the GIP deal, increasing its foothold in digital infrastructure, power, and port investments on a global scale.

Implications for BlackRock: A Foray into Digital Infrastructure, Power, and Ports

Upon completion of the deal, BlackRock is poised to emerge as a major player in the realms of digital infrastructure, power, and port investments worldwide. This acquisition strategically aligns with BlackRock’s vision to diversify its investment portfolio and tap into burgeoning sectors with substantial growth potential.

GIP’s Recent Transaction: Italo Stake Sale to the Mediterranean Shipping Company

In a separate development, on October 3, 2023, GIP made headlines by entering into a binding agreement to sell approximately 50% of its stake in Italo, Nuovo Trasporto Viaggiatori. Italo is a private high-speed rail operator, and the stake sale was orchestrated with the Mediterranean Shipping Company. This move adds another layer to GIP’s dynamic portfolio and underscores its strategic decisions in the rapidly evolving landscape of infrastructure investments.

Shaping the Future of Investments

The acquisition of GIP by BlackRock represents a pivotal moment in the financial landscape. With both entities bringing their unique strengths to the table, this collaboration is poised to shape the future of infrastructure investments globally. As BlackRock steers towards a more diversified portfolio, the market awaits the transformative impact of this strategic alliance on the financial industry and the broader economy.

Source: TechPoint

Leave a Reply