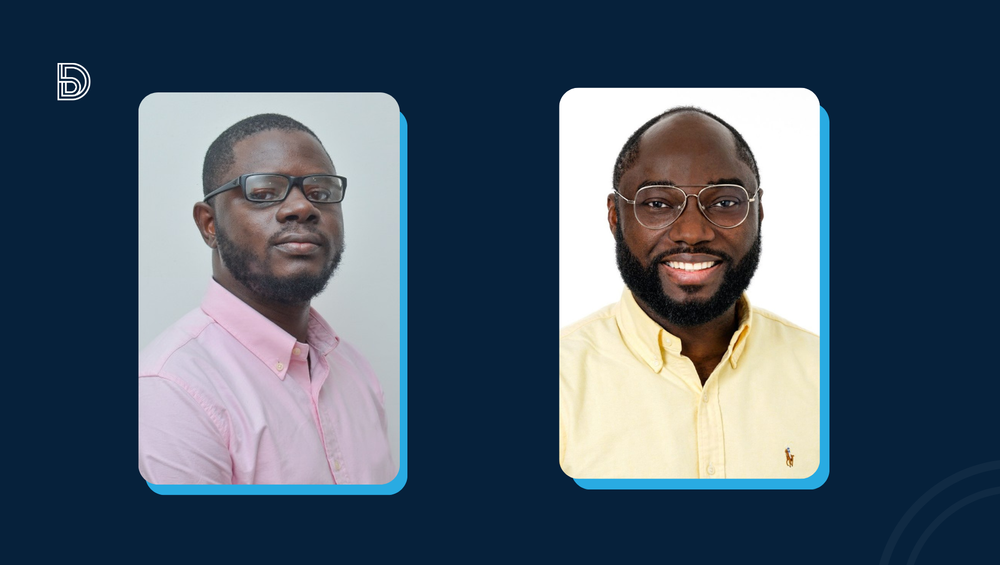

In a surprising turn of events, Cova, the brainchild of co-founders Oluyomi Ojo and Yomi Osamiluyi, has officially wrapped up its ambitious journey after a succinct two-year tenure. The co-founders communicated the unfortunate news to users through an email, assuring them that subscription refunds would be diligently processed by February 13, 2024.

Established in 2021, Cova set out to carve a niche for itself as a comprehensive platform, envisioning a space where users could effortlessly monitor and manage all their assets in one unified environment. This bold vision positioned the startup in the dynamic realm of fintech, with a particular focus on offering lending, investment, and savings solutions through cutting-edge digital financial services.

The sudden shutdown of Cova has left both its loyal user base and dedicated staff grappling with uncertainty. As the digital curtain falls on the startup’s operations, the unanswered questions surrounding the reasons behind its closure add an air of mystery to the narrative.

Cova’s journey was not without its fair share of challenges. Operating in the competitive fintech landscape, the startup faced hurdles such as the burgeoning customer demand for deeper integration and the pivotal need to establish trust in a relatively new and innovative concept. The intricacies of navigating these challenges may have contributed to the ultimate decision to cease operations, although the exact reasons remain undisclosed.

Central to Cova’s business model was its subscription-based revenue system, where users paid a varying range of fees, from $10 to $100 per month or year. This approach allowed customers access to the array of financial services the platform had to offer. However, the fee structure, while contributing to revenue, presented its own set of challenges, with the startup contending with the delicate balance of pricing accessibility and sustaining a viable business model.

As the fintech industry continues to evolve, Cova’s closure underscores the unpredictable nature of the startup landscape. The vacuum left in its wake raises questions about the fate of its dedicated staff and the impact on its loyal customer base. In the aftermath of this unexpected denouement, only time will tell how the narrative of Cova’s rise and fall will resonate within the annals of the Nigerian fintech ecosystem.

Addressing hurdles encountered in its inaugural year, Ojo remarked, “The demands from customers are incessant. For instance, we’ve got users clamoring for more extensive integration. They possess multiple bank accounts spanning different countries and are eager to seamlessly connect them with COVA.” He further acknowledged the ongoing challenge of establishing trust, stating, “Our innovative approach is still unfamiliar, and people are grappling with the novelty. Consequently, they have myriad questions, and it becomes imperative for us to earn their trust. Additionally, there are individuals who are resistant to viewing death as an event to prepare for, particularly in the context of African countries.”

Source: Techpoint

Leave a Reply