Quick Summary:

-

GTCO becomes the first Nigerian and West African bank to list shares on the London Stock Exchange

-

$105 million raised from 2.29 billion new shares issued

-

Dual listing strategy protects Nigerian retail investors and boosts global investor access

-

Capital will support expansion in East Africa, UK, and Senegal

Guaranty Trust Holding Company Plc (GTCO) made history on July 9, 2025, by becoming the first Nigerian and West African financial institution to list its ordinary shares on the London Stock Exchange (LSE).

This milestone marks a significant step in the group’s global growth journey, reinforcing its ambition to become Africa’s most respected financial services group.

Strong Market Confidence Powers Capital Raise

Following a successful offering on the Nigerian Exchange (NGX), GTCO’s dual listing raised $105 million through the issuance of 2.29 billion new ordinary shares.

The public offering attracted strong interest from long-term institutional investors, underscoring confidence in GTCO’s governance, performance, and growth prospects.

New Era of Transparency and Global Access

The shares were admitted to trading under the UK Financial Conduct Authority’s Equity Shares (International Commercial Companies Secondary Listing) category.

GTCO Group CEO, Segun Agbaje, led the official listing ceremony at the LSE headquarters in London.

“This was not just about raising capital,” Agbaje said. “It was about validating the strength of our franchise, the clarity of our strategy, and the discipline with which we execute.”

From GDRs to Full Share Listing

Previously, foreign investors could only access GTCO shares via Global Depository Receipts (GDRs). Now, the company offers direct shareholding opportunities, increasing transparency and liquidity for global investors.

This transition reflects GTCO’s commitment to international governance standards and investor inclusivity.

Dual Listing Strategy: Local Loyalty Meets Global Reach

GTCO adopted a dual capital raise strategy, raising ₦209 billion locally before entering the international market to avoid diluting its base of Nigerian retail investors—who account for over 50% of its shareholders.

On July 10, 2025, the Nigerian Exchange admitted an additional 2.28 billion ordinary shares at ₦70.00 per share, bringing the total issued shares to 36.4 billion.

Fueling Regional Expansion

The capital raised will be used to strengthen GTCO’s balance sheet and support expansion in high-growth markets. While Nigeria still accounts for 67% of its profits, GTCO is focusing on:

- Increasing contributions from East Africa (currently 1.5%)

- Scaling operations in the UK (currently 1.8%)

- Launching operations in Senegal, its next strategic market

Rather than rapid expansion, the group is concentrating on deepening competitiveness in existing markets.

A Pan-African Powerhouse in the Making

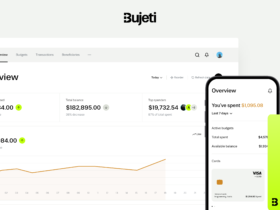

With a presence in 11 countries and operations across banking, payments, pensions, and asset management, GTCO’s LSE listing signals its readiness to compete globally.

This milestone reaffirms that African financial institutions can meet international standards and thrive on the global stage.

Leave a Reply