The African Export-Import Bank (Afreximbank) has reported that the third Intra-African Trade Fair (IATF2023), held in Cairo from November 9 to 15, has yielded a remarkable US$43.8 billion in business deals and transactions. The organizers disclosed that these deals spanned 21 sectors and involved 52 countries, totaling 426 agreements.

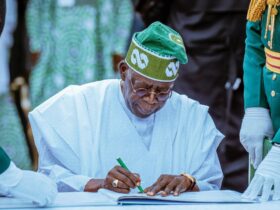

During a press conference in Cairo, Mrs. Kanayo Awani,

the Executive Vice President (Intra-African Trade Bank) at Afreximbank, shared further details about the successful event. The trade fair attracted participation from 130 countries, featuring 1,939 exhibitors and drawing 28,282 participants who attended both physically and virtually through the IATF platform.

A notable transaction highlighted was the Export Agriculture for Food Security Framework, a collaboration between several African countries (as Origin Countries) and ARISE Integrated Industrial Platforms, Arise IIP (as Anchor Investor). Afreximbank committed US$2 billion to support the initiative, aimed at enhancing production, processing, and intra-African trade in agricultural products, providing African farmers and agribusinesses access to broader markets across the continent.

Mrs. Awani emphasized that IATF has solidified its position as the premier trade and investment event in Africa, contributing significantly to boosting intra-African trade and investment, particularly in the context of implementing the African Continental Free Trade Area (AfCFTA) Agreement. She expressed pride in the event’s success, building on the achievements of IATF2018 and IATF2021, and anticipates that the impact of IATF2023 will resonate across Africa and beyond for years to come.

IATF2023, which commenced on November 9, featured various events, including an official opening ceremony, a Presidential Summit addressed by President Abdel Fattah Al Sisi of Egypt, a Trade and Investment Forum, the Creative Africa Nexus (CANEX), an African Auto Forum, AU Youth Entrepreneurship Programme, a Sub-Sovereigns Conference, a Diaspora Summit, an African Industrialization Week, and an African Tourism Sustainability and Investment Forum. Algeria is slated to host the next edition of the IATF in 2025.

About Afreximbank

Afreximbank, the African Export-Import Bank, stands as a Pan-African multilateral financial institution with a core mandate to finance and facilitate both intra- and extra-African trade. With a three-decade legacy, the Bank has consistently employed innovative financial structures to provide funding solutions that contribute to reshaping Africa’s trade landscape, propelling industrialization, and fostering intra-regional trade. This strategic approach plays a pivotal role in fueling economic growth throughout the continent.

As a steadfast advocate of the African Continental Free Trade Agreement (AfCFTA), Afreximbank has introduced the Pan-African Payment and Settlement System (PAPSS), recognized and adopted by the African Union (AU) as the foundational payment and settlement platform for implementing the AfCFTA. Collaborating closely with the AfCFTA Secretariat and the AU, the Bank is actively establishing a US$10 billion Adjustment Fund designed to assist countries in effectively participating in the AfCFTA.

By the close of 2022, Afreximbank’s robust financial standing was reflected in total assets and guarantees surpassing US$31 billion, with shareholder funds amounting to US$5.2 billion. Notably, the Bank disbursed over US$86 billion between 2016 and 2022, showcasing its substantial contribution to financing critical projects and initiatives. Afreximbank boasts investment grade ratings from reputable agencies such as GCR (international scale) (A), Moody’s (Baa1), Japan Credit Rating Agency (JCR) (A-), and Fitch (BBB).

Afreximbank has evolved into a comprehensive group entity encompassing the Bank itself, an impact fund subsidiary named the Fund for Export Development Africa (FEDA), and an insurance management subsidiary, AfrexInsure. Together, these entities form “the Group,” collectively reinforcing Afreximbank’s multifaceted approach to fostering economic development and trade advancement across the African continent.

Leave a Reply