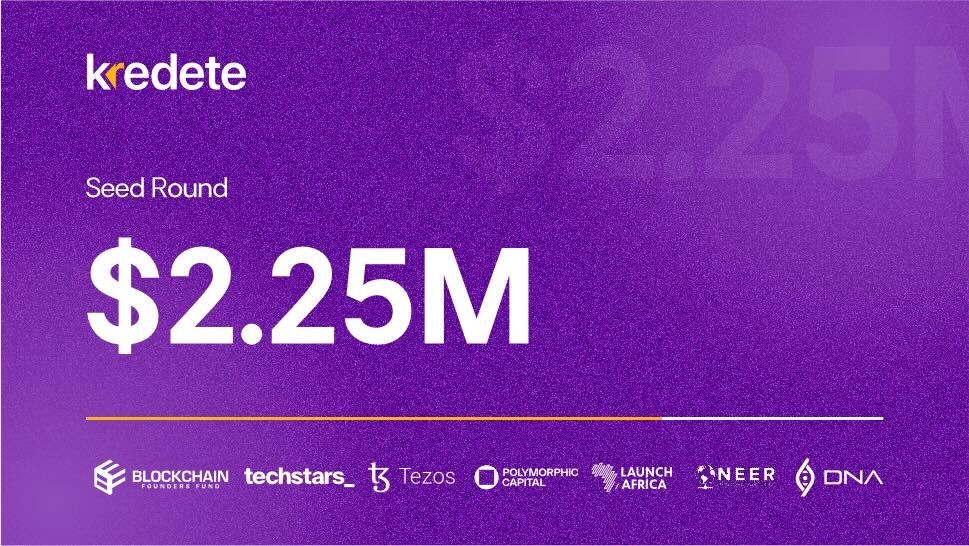

Kredete, a financial software platform tailored to support African immigrants in building credit and facilitating money transfers back home, has successfully raised $2.25 million in seed funding.

Leading Investors and Strategic Partnerships

This funding round was spearheaded by BFF, with additional contributions from Techstars, Tezos Foundation, Polymorphic Capital, Launch Africa, Neer Venture Partners, SDF, and DNA Fund. The round also saw participation from angel investors with backgrounds in payment solutions like Wise and Western Union, further solidifying Kredete’s credibility in the fintech space.

Bridging the Financial Gap for African Immigrants

Kredete is designed to address the financial challenges that African immigrants often face, such as difficulties in establishing credit in their new countries while continuing to support families back home. The platform enables users to send money to over 20 countries with low transaction fees, with each transfer contributing to the user’s credit score in their host country.

Innovative Technology for Financial Inclusion

By leveraging advanced technology, Kredete offers an affordable and efficient solution that helps users build a solid financial foundation in their new homes. The platform transforms the necessity of remittances into a credit-building opportunity, making a significant impact on the lives of African immigrants.

This innovative approach allows users to establish credit histories, easing their integration into the financial systems of their new countries. Kredete is emerging as a vital resource for African immigrant communities seeking to establish themselves in new environments.

Rapid Growth and Positive Impact

Since its launch, Kredete has experienced rapid user growth, with over 300,000 users now on the platform. On average, users have reported a 23-point increase in their credit scores within six months of using Kredete, underscoring the platform’s crucial role in promoting financial inclusion.

Leadership Driving Success

Kredete’s success can be attributed to its strong leadership team. Adeola Adedewe, the Founder and CEO, emphasizes that the platform’s core mission is to empower users to secure their financial future, regardless of where they migrate.

Chief Technology Officer Hakeem Oriola oversees all engineering operations, ensuring the platform remains robust and scalable. Chief Product Officer Ebuka Arinze focuses on product innovation, delivering financial solutions specifically tailored for African immigrants. Fey Sowunmi, leading the Customer Experience team, ensures that each user interaction is smooth and satisfying, reinforcing Kredete’s commitment to exceptional service.

Future Expansion Plans

Looking ahead, Kredete plans to expand its money transfer services to all African countries, beyond the 20 currently supported. The platform also aims to introduce additional financial products for African immigrants, including credit cards, auto loans, and mortgage loans. Kredete’s long-term vision is to create a comprehensive financial ecosystem that addresses the unique needs of African immigrants, enabling them to succeed in their new financial environments.

Reducing Costs with Stablecoins

One of Kredete’s key differentiators is its use of stablecoins, which significantly reduces transfer fees to under a dollar, setting it apart from traditional remittance services. This cost-effective approach makes Kredete a preferred choice for African immigrants seeking affordable and reliable money transfer options.

Positioning for Leadership in the Fintech Space

As Kredete continues to expand, it is well-positioned to become a leading financial service provider for African immigrants moving to North America. By simplifying the process of credit building and financial management, Kredete is contributing to a more inclusive and equitable economic future for African immigrants.