Finances serve as the vital sustenance for any business, and without it, even the most ingenious entrepreneurs face the risk of faltering or coming to a standstill.

Securing initial capital and resources for business growth is growing increasingly demanding for Nigerian businesses, especially in a climate where bank loans are expensive and often unattainable.

Here are seven potential sources of funding that small business proprietors can pursue to expand their business operations:

- Tony Elumelu Foundation

The Tony Elumelu Foundation (TEF), a prominent philanthropic organization in Africa, has supported 200,000 entrepreneurs across 54 African nations by providing them with initial funding of $5,000 each.

The Tony Elumelu Foundation has provided financial support, primarily in the form of $5,000 grants, to 9,631 entrepreneurs hailing from 54 African countries.

Several years ago, Mr. Elumelu allocated $100 million specifically to assist African entrepreneurs. If you are involved in sectors such as agriculture, fashion and design, light manufacturing, ICT, solid minerals, and more, you have the opportunity to apply for the Tony Elumelu Foundation Fund.

- The Bank of Industry (BOI)

offers a variety of funding options accessible to entrepreneurs at various stages of their business journey. These include:

The Graduate Entrepreneurship Fund (GEF), designed to support members of the National Youth Service Corps (NYSC).

The Cottage Agro Processing (CAP) Fund, tailored for small and medium-scale agro processors.

The Nolly Fund, aimed at supporting professionals in the Nollywood industry.

The Fashion Fund, catering to designers and other participants in the fashion value chain.

Specific funds targeting manufacturers, such as the CTG Fund for textile producers and the Cassava Bread Fund.

- Norrenberger

Norrenberger is an integrated financial services group that provides bespoke financial solutions.

Recently, Norrenberger unveiled its entrepreneurship fund, targeting 5,000 youths with an N500 million start-up grant.

In line with the company’s mission, it provides access to alternative funding options, enabling individuals to materialize their creative concepts and enhance their established enterprises.

The program is designed to empower recent graduates, concurrently mitigating unemployment, fostering wealth creation, and bolstering national security.

- Jack Ma Africa’s Business Heroes

Africa’s Business Heroes (ABH) represents the Jack Ma Foundation’s primary charitable initiative in Africa, dedicated to backing entrepreneurs. The foundation’s objective is to highlight and foster local talents who are making a beneficial difference in their communities and beyond, while also igniting a wave of entrepreneurship across Africa.

This initiative welcomes entrepreneurs from all 54 African nations, and the annual program concludes with the distribution of a $1.5 million grant shared among the top 10 finalists.

This program spans a decade and acknowledges 100 African entrepreneurs, offering them grant funding, educational initiatives, and comprehensive support for the expansive entrepreneurial landscape in Africa.

It provides financial backing to a wide range of businesses across sixteen diverse sectors, encompassing agriculture, beauty and wellness, construction, consulting, education, energy, environmental preservation, financial services, food and beverage, healthcare, information and communication technology, logistics, manufacturing, media and entertainment, retail, and transportation.

- Orange Corners

is an incubation initiative that offers ambitious young Nigerian entrepreneurs access to a modern and vibrant workspace, enabling them to collaborate and engage with peers who share similar goals and aspirations.

Orange Corners Lagos is developed and funded by the Netherlands embassy in Lagos and implemented by the FATE Foundation.

It provides funding for prototype business development for entrepreneurs who are within 18- 35 years with innovative business models in Education, Health, Agriculture and the Creative sector.

- LSETF Loans

The Lagos State Employment Trust Fund (LSETF) has earmarked N25 billion to provide support for small and medium-sized enterprises (SMEs). While this initiative was initiated by Akinwumi Ambode, the former governor of Lagos State, authorities have assured that it will persist due to its positive impact on the state’s residents.

The fund is divided into two segments: micro and small businesses. In the micro category, businesses can access loans of up to N500,000 at a five percent interest rate, with a repayment period of one year. For the small business category, businesses are eligible for loans of up to N5 million with a three-year repayment period.

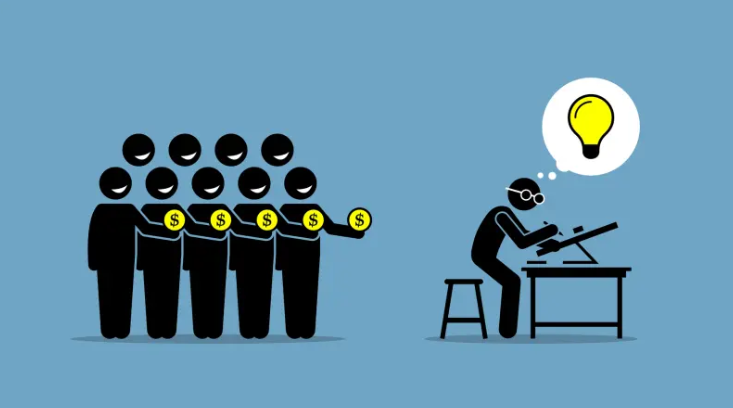

- Crowd Funding

In recent years, crowdfunding has emerged as a viable alternative for entrepreneurs seeking to secure funding for their business concepts.

This method involves financing a project or business venture through the collective contributions of numerous individuals, each providing relatively small amounts of money, often through online platforms.

It is initiated by various organizations or individuals to back a wide range of endeavors, such as journalism, disaster relief efforts, political campaigns, startup capital, film production, artist support from their fans, and scientific research, among other activities.

While awareness of crowdfunding remains somewhat limited among Nigerian startups, some entrepreneurs are already leveraging this approach to gather financial support for their enterprises.