Shekel Mobility, a smart fintech focused on auto dealerships, has secured $7 million in funding, comprising $3.2 million in equity and over $4 million in debt. The funding round involved participation from various investors, including Ventures Platform, Y Combinator, Rebel Fund, Unpopular Ventures, Maiora Capital, PageOne Lab Inc., Phoenix Investment Club, Heirloom VC, Pioneer Ventures, and several angel investors. Notably, the debt component was provided by Zedvance, VFD Microfinance Bank, Zenith Bank, Fluna, and others.

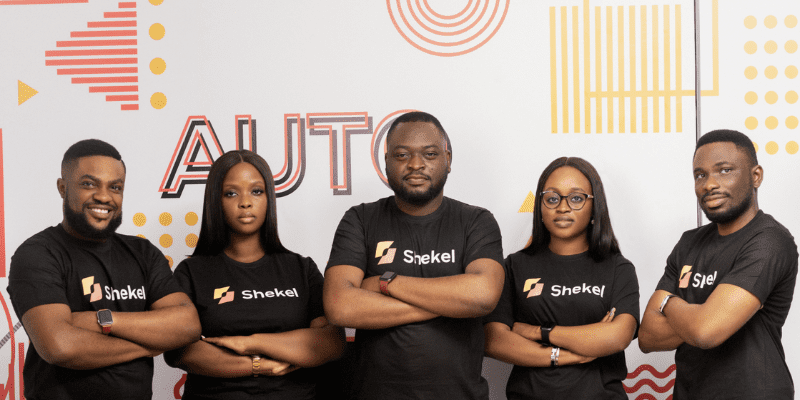

Co-founder Benjamen Oladokun

stated that this investment will significantly enhance the company’s impact, with a focus on assisting car dealers in Africa. The funding comes at a time when there is a rising demand for 2.4 million cars and 300,000 commercial vehicles annually in Africa due to increasing disposable income, a growing middle class, and rapid urbanization, as reported by the World Economic Forum.

Despite this demand, Africa’s car ownership remains below 45 cars per 1000 people, significantly lower than the global average of 203. While startups like Autochek and Moove have addressed consumer and driver needs, there is a growing need for solutions tailored to vehicle sellers in Africa, a gap that Shekel Mobility aims to fill.

The crux of the startup’s expansion revolves around its primary service, Shekel Credit. This offering provides immediate financing to auto dealers, offering credit limits of up to $200,000 for the purchase of vehicles, typically ranging from $5,000 to $20,000.

In this financing arrangement, the dealer contributes 30% of the total cost, such as $3,000 for a $10,000 car, while Shekel covers the remaining 70% as a loan to the dealer. Once the vehicle is sold to the end customer, typically within three months, the dealer repays Shekel, covering the loan interest and transaction fees associated with the car sale.

This model, where Shekel Mobility oversees the entire process of buying and selling cars through dealerships, ensures a zero percent default rate, as mentioned by Oladokun. Olukanmi also emphasized in a statement that while there is a significant gap in providing direct financing to auto dealers, Shekel Mobility selectively finances dealers it believes will have a lasting positive impact on consumers.

Expansion beyond credit: Shekel Mobility’s innovations

Leveraging the success achieved in the past 20 months with its credit product, Shekel Mobility has plans to introduce additional services, including Shekel Business. The founders clarify that this new offering aims to digitize informal trading processes within the auto dealership sector. This suite of tools is designed not only to assist dealers in financing their inventories but also in optimizing sales and organizational processes.

Benjamen Oladokun highlighted a key feature of their system, which allows the purchase of a car without requiring collateral. Initially focused on lending to dealers, Shekel Mobility is now expanding its scope to provide additional digital tools and physical infrastructure, with the goal of reducing the overall cost of owning car dealerships

Kola Aina of Ventures Platform emphasized that Shekel is pioneering a transformative innovation in the market, playing a vital role in the advancement of Nigeria’s and, ultimately, Africa’s automotive sector. Likewise, Marlon Nichols, the founder and managing partner at MaC Venture Capital, commented on the investment round, stating that Shekel Mobility has the potential to bring about a revolution and stimulate growth in Africa’s automotive industry by offering essential financing and assistance to small businesses.

He further noted that the Shekel Mobility team is facilitating the movement of millions of dollars within the Nigerian economy while simultaneously providing locals with access to affordable automobiles.

Source: Benjamen Oladokun

Leave a Reply