The Swiss development finance institution, SIFEM, has announced a $15 million commitment to the first close of Ninety One’s Africa Credit Opportunities Fund 3. The fund, which seeks to raise a total of $500 million, focuses on channeling private credit investments into businesses across Africa and other emerging markets.

Supporting Medium-Sized Enterprises for Economic Growth

SIFEM’s investment will serve as an anchor in the fund, which is managed by responsAbility Investments. The initiative is tailored to bolster medium-sized enterprises, providing them with the necessary financial support to enhance economic resilience, foster job creation, and promote sustainable development across the continent.

Strategic Partners Strengthen the Fund’s Foundation

The first close of the fund attracted contributions from several key strategic partners. Notable among them are the International Finance Corporation and British International Investment, both of which joined SIFEM as anchor investors. Standard Bank of South Africa also participated, serving as a credit provider and further reinforcing the fund’s financial foundation.

A Vision for Transformative Investment

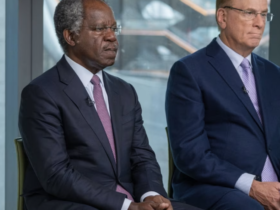

Anthony Mwangi Njoroge, Principal and Co-Head of Africa Fund of Funds at responsAbility Investments, emphasized the transformative potential of this initiative:

“This underscores SIFEM’s strong commitment to promoting sustainable development in Africa. By providing essential capital to medium-sized enterprises, we contribute to strengthening economic resilience, creating quality jobs, and supporting businesses that advance both social progress and environmental sustainability.”

Advancing Sustainable Development in Africa

The collaboration between SIFEM and responsAbility demonstrates a shared vision of fostering impactful investments across Africa’s emerging markets. By focusing on businesses with high-growth potential, the partnership aims to drive significant economic and social progress while prioritizing sustainability. This commitment underscores the vital role of private credit in shaping Africa’s future, ensuring long-term benefits for businesses, communities, and the broader economy.