Quick Summary:

-

Nigerian stocks have surged 136% since President Tinubu assumed office in May 2023.

-

The NGX market capitalization has grown by ₦45 trillion, reaching ₦75 trillion in 2025.

-

Domestic investors now dominate the stock market, contributing over 80% of transaction volume.

-

Economic reforms and banking recapitalization are driving the current bull run.

Historic Rally in Nigerian Equities

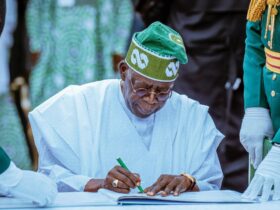

Nigerian stocks are currently experiencing their most impressive run under any civilian administration since 1999, with the All-Share Index (ASI) soaring by 136% since President Bola Ahmed Tinubu assumed office in May 2023.

As of May 29, 2023, the ASI stood at 55,769.28 points. Today, it hovers around 131,000 points, a record milestone for the Nigerian capital market. This represents the highest gain ever recorded at this stage of any presidency in the Fourth Republic.

How Tinubu’s Performance Compares

For historical perspective:

- Muhammadu Buhari (2016): ASI gained only 4.47%.

- Goodluck Jonathan (2013): ASI rose by 47%.

- Umaru Yar’Adua: ASI crashed by 49% due to the 2008 financial crisis.

- Olusegun Obasanjo (2001): ASI posted 115% gains.

In terms of market capitalization, the Nigerian Exchange (NGX) has jumped from ₦30 trillion in May 2023 to over ₦75 trillion—a staggering ₦45 trillion increase in value.

What’s Fueling the Market Boom?

Several factors are contributing to the bull run, many of which stem from Tinubu’s bold economic reforms:

- Fuel subsidy removal and exchange rate unification restored investor confidence.

- Global institutions have praised the market-friendly approach, despite local economic strain.

Supporting Drivers Behind the Rally

Other factors helping the market surge include:

- CBN recapitalization drive, with over ₦5 trillion expected to be raised by 2026.

- Increased liquidity from higher FAAC allocations post-subsidy removal.

- Limited forex speculation, pushing capital into equities.

- High interest rates (MPR at 27.5%) driving investment in equities and bonds.

- Strong corporate earnings, despite inflation and weak consumer spending.

- Excess money supply from Buhari-era deficit financing.

Local Investors Are Leading the Charge

Local retail and institutional investors are dominating the current rally, while foreign participation remains cautious.

- Q1 2025: Domestic transactions hit ₦1.418 trillion, making up 63.63% of total volume.

- May 2023–May 2025: Domestic equity trades reached ₦9.375 trillion, compared to ₦2.159 trillion by foreign investors.

This marks a significant shift toward homegrown market confidence.

Sector-by-Sector Highlights

Key sectors seeing record growth:

- Banking: Added over ₦7 trillion in value. GTCO and Zenith Bank alone account for nearly ₦3.7 trillion.

- ICT: MTN Nigeria gained over ₦3 trillion; Airtel Africa added ₦1.8 trillion.

- Oil & Gas and Agriculture: Attracting fresh capital and investor interest.

- New Listings: Aradel Holdings added over ₦2 trillion. Potential IPOs from Dangote Fertilizer and NNPC could add momentum.

What Lies Ahead for the Market?

As of mid-July 2025, Nigerian equities are up 27.84% year-to-date. Analysts project more double-digit growth through the year.

If this trajectory continues, President Tinubu could emerge as Nigeria’s most impactful leader for stock market growth.

Caution Amid Celebration

Despite market gains, many Nigerians face rising inflation, high cost of living, and economic uncertainty. While investor optimism remains high, public perception may ultimately hinge on broader economic outcomes—jobs, services, and affordability.

Still, one fact is clear: Nigerian stocks are in a historic bull run, and it’s happening under Tinubu’s watch.

Leave a Reply