In brief

- Mike Novogratz declared the “age of speculation” in crypto is over, shifting to real-world asset tokenization.

- Galaxy is launching a $100 million hedge fund with 30% crypto exposure, 70% in financial services stocks.

- An October 2025 flash crash wiped $19 billion in derivatives, leaving a lasting impact on market narratives.

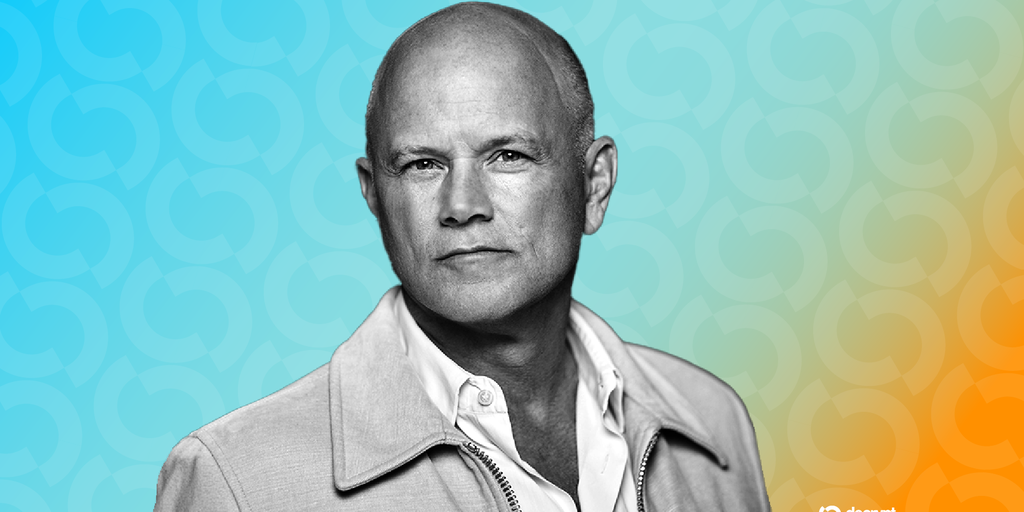

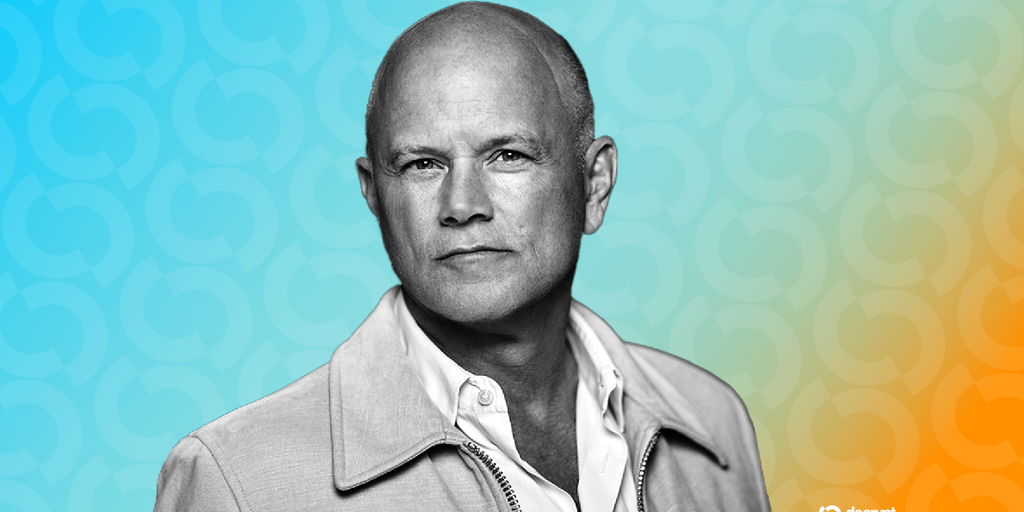

The “age of speculation” that captivated crypto traders is ending, Galaxy CEO Mike Novogratz told CNBC in an interview Tuesday.

Instead, he told the news outlet the market is “going to be transposed or replaced by us using these same rails, these crypto rails, to bring banking [and] financial services to the whole world. And so, it’s going to be real-world assets with much lower returns.”

Novogratz said the recent shift in crypto market dynamics is a reflection of change in the broader finance sector. He compared the November 2022 drawdown that followed the bankruptcy of crypto exchange FTX to the October 2025 flash crash that wiped out $19 billion worth of crypto derivatives.

Although there wasn’t one big event (like the FTX wipeout) to trigger the October Bitcoin crash, it still left a mark.

“Crypto is all about narratives, it’s about stories,” he said. “Those stories take a while to build and you’re pulling people in… so when you wipe out a lot of those people, Humpty Dumpty doesn’t get put back together right away.”

But that doesn’t mean he’s lost his taste for crypto markets.

Galaxy just launched a $100 million crypto hedge fund aimed at balancing crypto exposure with equities. The fund is set to launch before the end of March.

It will invest up to 30% of its assets in crypto tokens, and the remainder in financial services stocks that Galaxy believes will be affected by changes in digital asset technologies and laws, according to a Financial Times report.

Novogratz also credited the growing interest in tokenization with driving a shift in crypto market dynamics. Tokenization is the effort to move off-chain assets, like stocks and bonds, onto the blockchain using tokens.

But, he added, tokenized stocks will have a “a different return profile” compared to the gains that crypto traders are used to chasing.

The price of Bitcoin has fallen more than 47% from its October all-time high mark above $126,000 to a recent price of $66,551, and fell near the $60,000 mark last week. Bitcoin is down 10% over the last week, with Ethereum matching that recent decline and top altcoins like XRP and Solana marking even sharper losses during the same span.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.