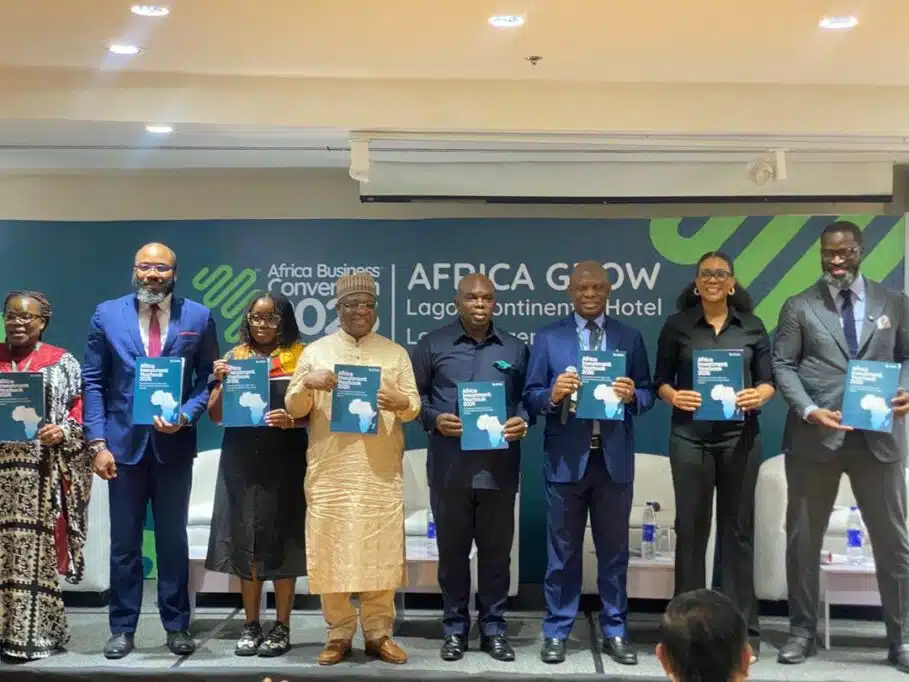

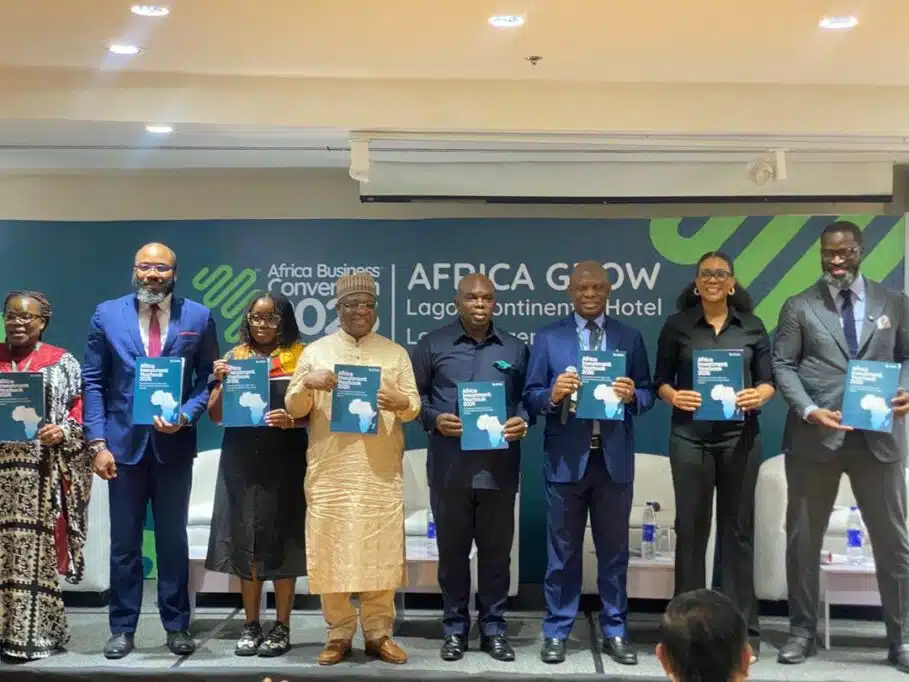

The Africa Business Convention (ABC) 2026, held on February 3rd and 4th, 2026, at the Lagos Continental Hotel, brought together policymakers, business leaders, investors, innovators, and entrepreneurs to tackle the defining question of how Africa can grow faster, fairer, and more sustainably.

Now in its fifth year, the annual gathering has cemented its reputation as a premier platform for high-level business-to-business (B2B) engagement, deal-making, and cross-sector dialogue.

Themed “Africa Grow”, ABC 2026 framed discussions around six strategic pillars: agriculture and food security; banking, investments and capital; environmental, social and governance (ESG); fintech, innovation and technology; jobs, economy and trade; and power, infrastructure and energy, reflecting the multifaceted nature of the continent’s expansion agenda.

The event was attended by several dignitaries from across Africa’s economic and policy ecosystem, including Wamkele Mene, Secretary-General of the African Continental Free Trade Area (AfCFTA); Jude Chiemeka, the Chief Executive Officer of the Nigerian Exchange Group (NGX); Dr Krishnan Ranganath, Regional Executive, West Africa, Africa Data Centre; and Dr Ifeanyichukwu Chukwunonso, Director General, Standard Organisation of Nigeria.

Building Africa’s financial architecture

A defining theme of the Convention’s opening discussions was that Africa has ambition; what it needs is the structural capacity to realise it. The first panel explored the complex ecosystem required to convert investment potential into tangible projects that can uplift economies.

Another session took a deeper dive into why capital often remains expensive or hesitant. The speakers asserted that capital needs three foundational assurances: disability (pipeline clarity), protection (risk governance), and velocity (ease of entry and exit), to flow effectively into markets. Without these, capital becomes expensive, and expensive capital kills infrastructure.

“We need better architecture, better instruments, better governance. Better data and better execution. In finance, winning requires structure, and if your defense is weak, your offense doesn’t matter. In business and finance, defense means governance, reporting, control, risk management, and transparency,” Ismael Adam Cisse, founder/CEO, Infinity Africa Group, said during his keynote speech.

A later plenary spotlighted critical infrastructure, especially power and digital connectivity, as the backbone of future growth.

“For me, growth is about time, legacy and how many of us are able to build a sustainable environment that all African businesses can thrive in,” Muyiwa Mataluko, CEO of Businessfront told attendees.

Across panels, the message returned to common threads: build structures that attract disciplined capital, link markets through investment in people and infrastructure, and cultivate environments where domestic savings fuel continental growth.